Paying off mortgage in 30 years sucks! What if I show you how to pay off your mortgage faster, would you be interested to learn.

When I bought my first house, paying off mortgage felt a burden to me. Although it was better than renting as per my circumstance. My Mortgage payment was lower than the market rent. Woohoo!

However, I was always thinking how to pay off my mortgage in five years. As a Banker, I knew that about 78% of total repayment of each month was interest payment. That means my home loan outstanding was not reducing much.

My main motivation to pay off mortgage in 5-7 years was to save interest payments and invest instead in stock market. I knew that this was the way to go if I want to achieve financial freedom.

Today, in this article, I will show you few practical steps to pay off your mortgage. It will enable you to pay off your debt and invest early.

Before discussing the techniques to pay off your mortgage early, let me share a few facts. The median income of American household is $5,161 after-tax a month. Their budget consists of paying utility bills, student loan instalment, credit card payment and other expenses as well as saving funds for future.

So they put their money in the bank either in checking or savings accounts. Then what do they do? They pay their all necessary expenses and loan instalment by their checking account and use the savings account for future unforeseen accidents or emergencies.

Average American Two-Income Family Earn in $5,161 | |

Bank | |

Checking Account | Savings Account |

Mortgage Car Credit Cost | Short |

In simper way, a US family earns $5,000 in a month and make a budget for their all expenses and future savings. That is a cash basis mentality. What does it mean? Cash basis mentality is that your expense what you earn. Even in an emergency, you try to avoid borrowing by your savings.

So we put our money in checking and savings account and we divide our money as per our budget. Usually people use their checking account for the following payments.

Checking Account:

Mortgage Loan: The average two-income American household is living in a three-bed room and two-bath house that average price is $200,000 and the average mortgage payment across the United State is $1,200 in a month. Usually the average rate of interest of a mortgage loan is 6.00%. It’s may be higher or lower but the average rate is 6.00% interest of a mortgage loan.

Car Loan Payment: The next thing people are paying for a car loan. Because most people have a car and they have to pay for a car payment every month. So the average car payment for a two-income American family is $600 in a month were the average loan amount of $13,000 with the average rate of interest is 5.00% to 6.00% for 5 to 7 years repayment period. The loan amount and interest can be higher or can be lower.

Credit Card Payment: Another thing is the credit card payment. Credit card is different than a loan. It’s a line of credit like over draft account. The average two-income American family has a $15,000 limit credit card with a $12,000 balance 21.00% APR. So they have to pay a minimum of $600 every month.

Cost of Living: The fourth item of the budget is the cost of living. It is different from each other. It depends on individual lifestyle. The cost of living means the expenses of your foods, water, groceries, and utility bills, and so on. So the average cost of living of a two-income American family is $1,200 in a month.

Savings Account: These four items were for expenses. Now I would like to talk about savings. People put their money in a savings account for their unforeseen happen and emergencies. Now the question is how much money they keep? The average two-income American family saves $1,400 every month. Maybe you think it’s a big number and maybe you never save like this big amount every month.

Yes! You are right, but I am talking about the average number. Moreover, it’s not only a savings account but also for a 401K plan that is long term saving. Every responsible people want to save for future. So people put their money in savings accounts and commonly in USA banks give 0.01% interest on deposits.

Average two-income family earn (a) | $5,000 | |||

Bank |

| |||

Checking Account | Savings Account |

| ||

Mortgage payment | $1,200 |

Long and short term savings |

$1,400 |

|

Car payment | $600 |

| ||

Credit card payment | $600 |

| ||

Cost of living | $1,200 |

| ||

Total (b) | $3,600 | $1,400 | $5,000 | |

Cash flow (a-b) | 0 | |||

From the above we got 3 banking products-mortgage loan, car loan, and credit card those have individual rate of interest and different calculation method. Here, mortgage and auto loan are lending by the bank a full amount for purchasing home and car. Bank sets a payment schedule that is called loan amortization schedule. And credit card is a line of credit. It’s like an overdraft facility.

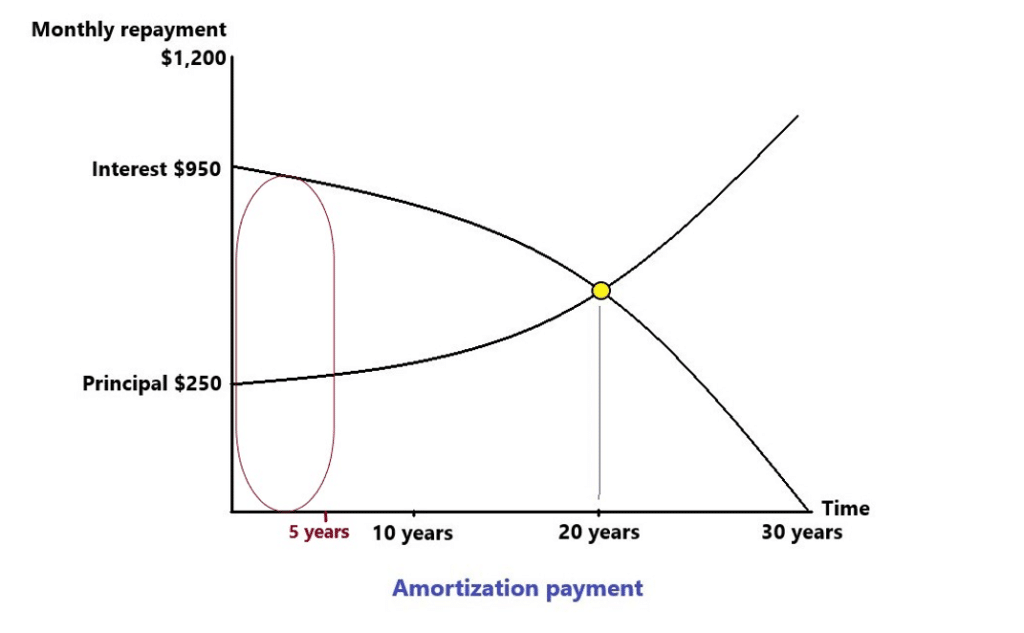

Amortization loan: Amortization is the process when you borrow money spreading out with the interest and principal payments over the term of the loan. That’s a mean lot of time when you borrow the money you paying a simple interest rate either every month or yearly basis.

With an amortize loan you spreading out the principal and interest payment toward the term. And mortgage loan is the perfect example for amortization. At the beginning of the mortgage you are paying a lot more interest and a small amount of principal. Let say the interest amount is 90% of monthly payment amount where only 10% is principal. And at the end 90% is going for the principal and 10% is for interest. In a 30 years mortgage loan after 20 to 22 years the principal amount will be higher that the interest.

You can starts payment following amortization schedule and after a certain time the full amount been paid. After making some payments you cannot withdraw again from this because it is one way repayment system.

So, every 5 to 6 years later bank offers for refinance.

There is a five-year indicator is this graph. What happen after five years in a 30 years mortgage loan? Usually, in United State people switch their job or they move after five to seven years. Because they get bored. Moreover, if the payments are regular the bank may offer refinancing the mortgage at a cheaper interest rate. And then what happen? We reset our mortgage payment schedule and it starts again from the beginning. That the reason for a lot of people unable to pay off the loan throughout their entire life.

I am going to show you a small calculation of your mortgage payment after 5 years. This is not the actual figure but it is very close to that.

5 years or 60 months later your payment is $1,200×60=$72,000 where Principal amount is $13,000 and $59,000 is interest. Yes! It’s surprising.

Let’s see another calculation-how to convert amortization to simple interest by using a formula. It is also not the 100% accurate but very close to.

If your amortization rate is 6.00% then the simple interest will be (6×2) ×10 = 120% simple interest. It’s so much right? Now let’s check this formula. If you have a $200,000 mortgage loan for 30 years period and 6.00% amortization interest rate, then after 30 years you total payment will be $431,676.38, here $231,676.38 is interest that is 115.84% simple interest.

Line of credit: Line of credit is a borrowing option that is approved credit limit by a bank. You can draw up to the limit and have to pay interest on what amount you have drawn not for the full limit. You only pay the interest that you have borrowed. You can borrow then pay down, borrow again and again and up to the limit. As soon as you use line of credit you start paying interest and have to pay a minimum payment.

Your credit card is your line of credit. Credit card balance has been

calculated daily and charges monthly. It is also revolving that’s mean two dimensional. Two dimensional means if you pay the minimum payment of credit card you can use the full limit of this card.

In USA the average rate of interest of credit card is 21.00% APR that is simple interest. This is higher that mortgage loan. In mortgage loan interest rate is 6.00% that is amortization interest. It’s cheaper that credit card interest, right?

Like this 21.00%

APR simple interest is cheaper than 6.00% amortization interest. 6.00% amortization interest is equal to near about 116.00% simple interest. Now it’s your choice, 21.00% simple interest or 6.00 amortization interest?

The technic of how to pay off your mortgage in 5-7 years:

Now I am going to share with you the amazing technic of how to pay off a 30 years mortgage loan in 5-7 years. At first you have to bypass the system of depositing in checking and saving account that you earn entire the month. You have to deposit your all monthly income in your credit card account that is under the line of credit, all of them. You may say, are you a crazy mad man?

How are we going to pay the mortgage? How do we eat? How do we pay the other bills? All the money you have put in the credit card. Friend! Stay with me, I am with you.

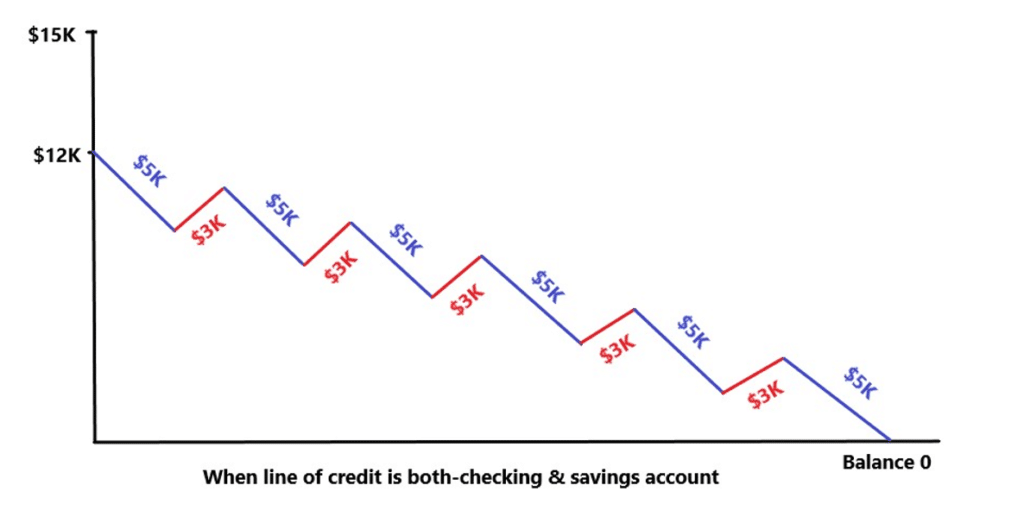

So, let say our credit card limit is $15,000 and its’ balance is $12,000. Now if I put $5,000 on to the line of credit what happens will be the balance? Yes! It goes down. But I have so many expenses that I have to pay, what can I do?

Well, if I put $5,000 on to the line of credit does the minimum payment of $600 is needed any more? No. Now come to the saving amount. Smart and intelligent people never save money in their saving account. Because banks give only 0.01% on deposit in a savings account. On the other hand if you consider the inflation rate,

ultimately you will be looser. Because in USA the inflation rate varies up to 2-4% You are the better manager of your personal finance than somebody else. So, should you put your money into savings account? Of course, no! Then people may say, what about my saving? What about my last age? Hold on everything will be solved.

Now I can change the pay impact. If I add up the mortgage, the car payment and the living expense that $3,000 in a month. So $5,000 is coming in and $3,000 in a month is expenses to pay. Now what about the cash flow? Now the cash flow is $5,000 – $3,000 = $2,000. Yes! Now you have $2,000 cash flow every month without changing your life style or reducing your daily expenses.

Now what will you do? You have to be more careful on using your credit card. So you have to follow 2 basic rules of using credit card. This will help you how to use credit card at the right way.

1. Emergency: You have to use credit card in emergency.

2. Debt pay down: Use your credit card for debt pay down.

Now what about your line of credit? Its $5,000 on and $3,000 off, what is the net pay down? It’s $10,000 at the first month. At the second month again $5,000 on and $3,000 off and net pay down is $8,000 Like this way how much time will it take to pay down at the zero? Its 6 months.

So many questions are right now. Will I pay my mortgage by credit card? What will I do if there is an emergency? Where will I get money if there is no saving?

Yes! You will pay your mortgage and emergency by your credit card. Let say, you have to pay the hospital bill $2,000 by your credit card because of the emergency. Then add an extra month to pay down your credit card balance at zero. Now it will take 7 months to make it zero. Your line of credit is both -your checking account and your savings account. Because we never going to use more than half of our line of credit at any one time. Why? Because its emergency and we know the 2 basic rules of using credit card, right?

See what happened! $12,000 credit card balance immediately has paid off in 6 months! It’s incredible, right? But there is a problem. If you full paid off of your credit card you may miss use it or may be spend for unnecessary purpose. But we know rules and you have to apply it. Now is there any emergency? No. So apply the 2nd rule. Spend the money to pay off your debt.

Because of that when you start to use the credit card this way, you keep your balance under 50%, you use the card every month but paying down more and more down you use it every month, and at 6th month you can call your credit card companies and you can get a credit limit increase at $25,000. That is $10,000 increased.

Now draw $13,000 from your credit card and apply it directly to the principal of your mortgage loan. You have to make sure that this is a principal only payment. This payment will be reduction of principal only.

If to pay off $12,000 takes 6 months then how long will it take for $13,000? It’s 6.50 or 7 months. What is happening here? If I pay off $13,000 after every 7 months then your every 7 months will be equal to 5 years. That’s mean you are escaping time as well as escaping interest.

So if you apply this technic you can make money $13,000 in every 7 months and your entire mortgage will be pay off within 5 years.