Do you want to start living your life being financially stable?

If you’ve made up your mind to pay off your debt, congratulations on that!

The journey of paying off debt is hectic, but once you start, the finishing line comes closer.

You can feel overwhelmed by looking at your pile of credit card debt but don’t worry!

Because you are not alone.

This report of US Today says that an average household holds four credit cards and the average balance of a credit card has become $6,200.

But better late than never!

If you want to, you can end the never-ending cycle of minimum payments and be debt-free once and for all.

Once you do it, you can then focus on your savings and investments.

Believe in yourself!

Paying off debt is not an impossible thing to do. By reading the story, you’ll know that you can do it too!

(Source: Medici)

A Real-Life Story to Inspire You

Christy paid off her $22,000 credit card debt in 3 years. Cool, right!

She was an employed woman who had an issue of overspending which led her to that debt.

Like every middle class American, she didn’t have a budget and lived from paycheck to paycheck.

According to her insolvency trustee, when she met them, she wasn’t even able to pay her monthly payments.

By using a consumer proposal, she paid $300 on a monthly basis for 3 years. The money paid by her was distributed to her creditors, and her counsellors kept 20% from that.

Because you must pay the cost of taking assistance from the professionals.

There’s something you can do too is keep track of all the things you spend on. It’ll help you understand how minor cut-outs can make a big change to your financial condition.

How Debt Affects Your Credit Scores

As everything in the world has both good and bad effects, debt has a bad impact on the credit score.

Credit card debt is a revolving debt that means the debt has a variable interest rate, and its balance can be carried from one month to another.

There’s always a fixed or predetermined credit limit up to which you can borrow.

If you have multiple credit cards and have a high amount of debt, your credit score can be hurt by that.

And it is likely that your credit score will be negatively affected if your credit balance exceeds your credit limit every month, particularly in cases where you’re doing it using multiple cards.

Let me explain it to you. The term ‘Credit utilization’ refers to the ratio of your outstanding credit card balance against your credit limit.

While calculating your credit score, this percentage carries significant weight.

So, keeping your balances low can be a great way to maintain your credit score. You can do it by paying your balance every month.

Why Say ‘No’ to Credit Card’?

A credit card doesn’t seem to be a bad influence until you find yourself drowning in $10,000 debt.

It starts with the card issuers lucrative 0% APR credit card offers. You get amazed at the opportunity and step into a hallow of debt.

But this, APR offer expires, but you don’t pay your debt on time. Eventually, you find yourself in a pile of debt without any clue how to come out of it.

Different Credit Card Repayment Methods

- Debt consolidation

Debt consolidation is a procedure by which you can roll up your credit card debts in a single debt. This is a good way because you can get a lower interest rate and reduce your total debt. It’s an easier and faster way to pay off your debt.

If you have debts with different interest rates and due dates, debt consolidation can make your way to financial freedom easier.

You can move all your existing balance to a new 0% APR credit card. By this you’ll be able to pay off your debt without paying any interest but in a limited time.

- Debt settlement

You can seek help from debt settlement companies so that you can negotiate with your creditors.

Here, professionals help you consolidate your debt and make a repayment plan for you.

These companies negotiate with your creditors to reduce your debt payment in exchange for a fee.

If you really got the chance to pay less, why waste it!

- 401(k) loans

The loan you take from your retirement plan is referred to a 401(k) loan which is a common way of borrowing money.

But borrowing for paying off another debt is not a good idea. And 401(k) should not be considered as a way out of debt because 401(k)s have a lot of drawbacks.

Like, if you lose your job, you’ll have to pay earlier than before. Moreover, if you can’t repay, it will be treated as a withdrawal and tax and penalty fees will be implied.

How to Pay Off Credit Card Debt

- Step 1: List your credit card debt

Make a list of all our credit card debts and mark the one with the lowest interest, highest interest rate, the smallest and the largest one. And now it’s time to decide which one you want to pay off first.

-

- Paying Off Debt with the Avalanche Method

By choosing this method, you decide to pay off the debt with the highest rate of interest.

This is the more prevalent way to pay off debt. Suze Orman is a major supporter of this proposal. Since you pay as little interest as possible, you can save money.

-

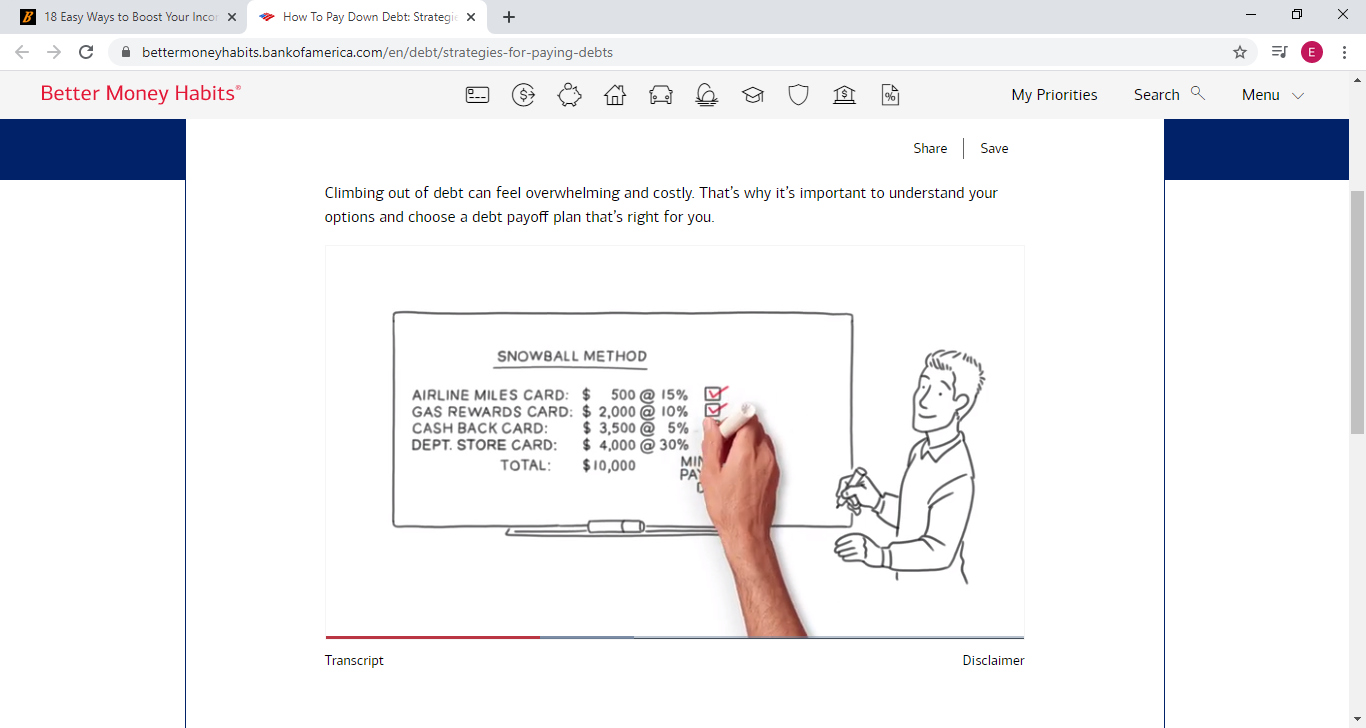

- Paying Off Debt with the Snowball Method

You can pay off the smallest debt first using this form. First, you eliminate your smallest debt, and when you’re done with that, you move forward to pay off the second-smallest one.

(Source: Better Money Habits)

The America’s respected financial guru, Dave Ramsey, also uses this phrase.

The theory is that you will be motivated to keep ‘snowballing’ your way out of debt while you remove small debts.

- Step 2: Target only one debt at a time

Don’t try to be smart in case of paying off debt if you have multiple credit cards, target one of those cards.

Don’t try to pay off all of those at the same time. Because that’s not a feasible idea to pay off faster.

If you want to be debt-free faster, always try to pay more than the minimum amount. If you don’t, it’ll take you more time to pay off your debt.

If you can’t afford much, payment of an extra $50 per month can help you a lot.

Before you start paying extra, make sure you won’t be charged a prepayment penalty for this by your lenders.

- Step 4: Reprioritize your budget

Don’t be annoyed! Making a budget is necessary when you are trying to work according to a plan.

Look at the monthly spending and select categories where you need to spend money every month and where not.

By categorizing, you’ll see how you were spending on unnecessary things till now.

- Step 5: Try to increase your income

- List the Unused Room

Look around your house? You might have a spare room in your house that can help you right now.

How?

Rent that room and earn money. This is one of the easiest sources of earning.

By having a tenant, you can share the expenses and earn from the rent.

If you don’t want a tenant, you can also enlist the room in Airbnb. Thus, you’ll be able to both earn money and not have to stay with someone for a long time.

Before that, you can use Airbnb’s calculator to know how much you can make out of it.

-

- Rent Your Car

The same goes for your car. You can enlist your car to any car-sharing company and earn a handsome amount of money.

With HyreCar, you can even earn $12,000 per year.

You just need to enlist your car, and like magic, you earn!

The people who don’t want to use their own car for Uber or who don’t have their own car, you can get connected to them by HyreCar.

Another car sharing marketplace named Turo offers you insurance coverage.

-

- Invest Your Savings

Always remember that investing is a part of saving. Everyone should have an investment portfolio with at least 7% yearly interest.

Like, if you have a $50,000 savings, you can get $3,500 every year if you invest it in a correct way.

Investing is just a way to increase your money using the money you have.

If you have invested your money somewhere safe, you don’t need to worry now. But if you haven’t, get started!

-

- Start a Blog

Blogging is such an interesting and effective way to earn. You can put your thoughts and ideas through your blogs and make money from that.

If you love writing, like connecting with people and helping them out, it can be great a way.

To be a successful blogger, you’ve to work hard. Yes, you won’t be that much successful in the beginning, but you have to go for it first, right? Otherwise, you won’t even know if it works for you or not.

-

- Be a Freelance Proofreader

If you like writing and reading, this can be an exciting thing for you which is proofreading.

Personally, I enjoy it. You can even learn how to do and what to do through different courses.

Caitlin Pyle started proofreading as a full-time job on Dec 2009. In 2015, she started Proofread Anywhere to help people know how she did it, and by it, she has earned more than ever.

And according to her website, she became a multimillionaire within four years.

So, what are you waiting for? If you’re interested, you can also go through this article. It’ll help you know everything about being a proofreader.

-

- Sell Designed T-Shirts

If you like art and designing, designing t-shirts can be a great source of income for you.

There are now a lot of websites where you can both design and sell designed t-shirts.

If you can come up with different ideas and if you can express your thoughts through your design, this is the best way for you to start earning now!

(Source: DesignHill)

Teespring, Redbubble are some of the sites you can visit to get an idea about it. It’ll let you both the chance to express yourself and earn extra money.

-

- Become a Search Engine Evaluator

The duties of a search engine evaluator are to analyze the relevance and accuracy of search results.

If you are good at working with a computer and internet, you can consider this as a good option.

A search engine evaluator conducts necessary research and gives feedback about the accuracy of search results.

Like, are the results relevant or not, are the result pages useful or not.

Leapforce is information evaluation service company. As they look for people for this, you can join them and work from home.

-

- Affiliate Marketing

Affiliate marketing is a unique technique of earning commission without making your product.

Here, affiliates promote the products or services of another person or company, in exchange for a commission on product sales, and the sales are tracked via affiliate links.

In this case, affiliates let product owners increase their sales by allowing them to target the same audience.

If you have a product and the desire of increasing its sale, you can offer promoters an incentive through an affiliate program.

On the contrary, if you want to earn money without having a product of your own, then you can be an affiliate marketer by promoting a product that you feel has value and can earn an income from it.

-

- Deliver with Uber Eats

Maybe you don’t have enough time to deliver, but you can take it as a part-time job. By working with Uber Eats, you can earn several hundred dollars within a few hours per week.

And at this time, an extra if $200 can help you pay your credit card debt faster.

-

- Flip thrift shop items and sell for profit

There are very few chances that you have never been to a flea market. And maybe you don’t have that much knowledge about which product can be sold at what price.

Yes, I’m saying that you can try to sell the product on profit that you’ve purchased from flea market.

It really is a great way to earn money.

Maybe you’re not an expert but at least try it out once!

-

- Sell your car

If you have multiple cars or have a car, you can sell it and earn some cash. Selling a car will help you in two ways.

You’ll be able to both earn cash and cut out some expenses at the same time.

Make a habit of walking to work or take the bus.

-

- Make extra money by paid surveys

Survey Junkie is such a site by which you can share your opinion get for that. Your opinion will be used to help brands understand customer behavior better.

It’ll help them deliver better products and services to their customers.

You’ll have to create a profile and when you complete a survey, you get points. These points can be used for PayPal or gift cards.

Swagbucks, InboxDollars, Vindale Research etc. are some the site you can visit.

-

- Sell unused items on Craigslist

You obviously have a lot of stuff in your house that is in such good shape that you could earn by selling those.

Try eBay, Craigslist, or Facebook Marketplace for selling your unused items. With this money, you’ll be able to make extra payments for your debts.

-

- Sell your old textbooks

If you have your old textbooks still in your house, it’s time to sell those and earn some cash.

BookScouter is a site of selling books. There you can sell your books at a higher price than the bookstore will offer you.

Here, you can compare the prices offered and chose the highest paying offer.

- Step 6: Reduce your expenses

- Try consignment shopping

As we’re trying to find ways to save your money, consignment shopping can be a great way.

Kids grow fast and need new clothes very often. So, you can look for consignment stores near you where they sell worn clothes of good condition.

If you prefer online shopping, thredUP and Swap.com can be great sources of adult and children’s clothing at a lower cost.

-

- Cut the cable

Most people now watch TV shows online. Some people are still paying their cable bills, and maybe you are one of them.

But paying the bills for your cable is a waste to me. Because you are paying for something every month, you don’t even use it now that much.

So, make your family watch their favorite shows online so that you can cut the cable for good and save that money.

-

- Add no-spend days to your calendar

The Motley Fool gave me the idea of a no-spend day. And I think this such an innovative way to keep yourself away from spending money.

You can get the idea by the name. On a no-spend day, either you buy nothing or buy only necessary stuff, such as toiletries.

If you have a no-spend day each week, you can restrain yourself from spending four days a month. Isn’t that great!

Should You Close Your Credit Cards After Paying Them Off?

Credit cards are a huge source of temptation and identity theft. According to this article, the cases of identity theft has increased at a very large extent.

I suggest that if you have paid off your debt and don’t want anything like this to happen, leave your credit card.

If you have paid off your credit card debt, don’t make the same mistakes again. There are two mistakes that we make even after getting out of debt once:

- Building up credit card debt again: Remember you created a budget to get out of debt before?

I suggest you create another budget that helps you preventing from overspending again. This way, you’ll be able to not build up a credit card debt again.

The temptation of overspending always will be there. What you have to do is to stick to your budget.

- Not building an emergency fund: People work so hard to pay off their debt in 18 or 24 months, but after the debt is paid off, they can’t build an emergency fund.

If you could pay extra $500 to pay off the debt, you should keep at least $100 in your emergency fund.

There’s a reason why the financial advisors ask everyone to build an emergency fund. That is, if you have an accident or need to buy a fridge now, right after you paid off the debt, probably you won’t have enough money for that.

It’s likely that you’ll look for options borrow then.

If you had an emergency fund, you wouldn’t even think about that. So, put an amount every month to your emergency fund.

Closing credit card accounts: It is a matter of consideration that closing the credit card accounts will hurt your credit score. So, you can keep your cards open but don’t take it with you when you go out or use it while buying something online.

If you’ve set your mind to get out of our credit card debt, you are on your way to do it no matter what happens.

Be determined!

Once you start repaying your debt, you find yourself in a repayment cycle while no more piling up more debt.

If you need assistance on your way to financial freedom, consult a credit counsellor of a non-profit credit counselling organization.

You’ll have to pay a fee for that, but you’ll get the help you need.

If you’re determined enough, you’ll achieve your financial freedom in no time!