What is a Monthly Budgeting?

A monthly budget is an illustrative list of accounts for every transaction of money either it goes in or out for a one-month-long period.

It includes all the cash inflow and outflow and records them accordingly mentioning the date, time, and person in the description. It keeps track of every dollar you receive by working and every dollar you spend on each thing or object.

Sounds like it’ll help you to manage your money. Without any doubt!

Monthly budgeting will lead you to a secure and guilt-free life. Also, it’ll make you save money by not spending the money on useless purchases and unnecessary things.

Does everyone like to make a Monthly Budget?

Frankly speaking, not everyone likes to put together a budget.

Why?

There are enormous reasons not to budget. Everyone thinks preparing a budget and then following it is too time consuming. They just hate it.

Moreover, there is a stereotype that only a person with finance or accounting knowledge or background can create a budget for managing money, which is not true at all.

The reasons why people hate budgeting are—

- Time-consuming

- Boring to do

- Depressing

- Continuous process

- Seems difficult

People don’t like preparing a budget because they reckon that it’s a waste of time, misuse of energy and finally, they think they don’t need one. Is it so? Don’t they need to make a monthly budget? Let’s drill more.

Budget is a simple concept that all the people are using without even realizing. After the inflow of money, you do have the plan and thoughts of the sectors where you are going to spend the amount. Like, you’ll anticipate paying the rent of your house (if you live in a rented house), pay the bills, buy groceries, educational cost and many more sectors that you keep in mind.

Why do people tell you to write down the options and make a monthly budget? Is there any reason behind this suggestion? Let’s make the importance of the budget clear to you then.

After knowing the benefits of a monthly budget, you will want to make sure that you put a monthly budget together and follow it accordingly. The importance of monthly budgets is mentioned here by—

- Track of your money and manage it as you wish

- Make a proper distribution of money to fulfil all the wants

- Get to prioritize your spending’s and expenditures in an appropriate way

- Know your money movements and identify the unnecessary costs

- Have a proper savings agenda for retirement plans

- Keep you out of any kind of debts or credit accounts

- Help you get out of bankruptcy and guide you to resolve debts

- Prepare a way for your desires and dreams to come true

So, as you can see, monthly budgeting is an effective and efficient way to get a better life and a secure future. It will help you remove all kinds of financial fear.

At this stage you might be wondering how I do the budget. Is it really for me? I will explain everything down below.

Do you need a budget?

You might be thinking budgeting is only applicable for corporations, businesses, and governments. This kind of thinking should be abolished.

In today’s lifestyle, every person needs a budget for themselves to ride on the right track. But only a few follow the budget.

Even if someone thinks about creating a budget on first day of new year, by the month of February, they forget about budgeting.

There are some signs that will make you want to create a budget—

- Have huge debts and are hopeless about repaying the commitment?

- Don’t have any financial goal or can’t decide your financial goal?

- Can’t identify where you are spending and where your money is going?

- Falling short with your cash inflow and going into debts to maintain your costs?

- Can’t afford a plane ticket to travel?

- Have no emergency fund to tackle any uncertain situation?

- Unable to save money for a retirement plan?

- Skipping your dreams owing to financial barriers?

Does any of these resonate with you? Then Yes, you do need to prepare a budget and spend your money accordingly.

I will show you step by step process how to prepare a budget that works for your lifestyle.

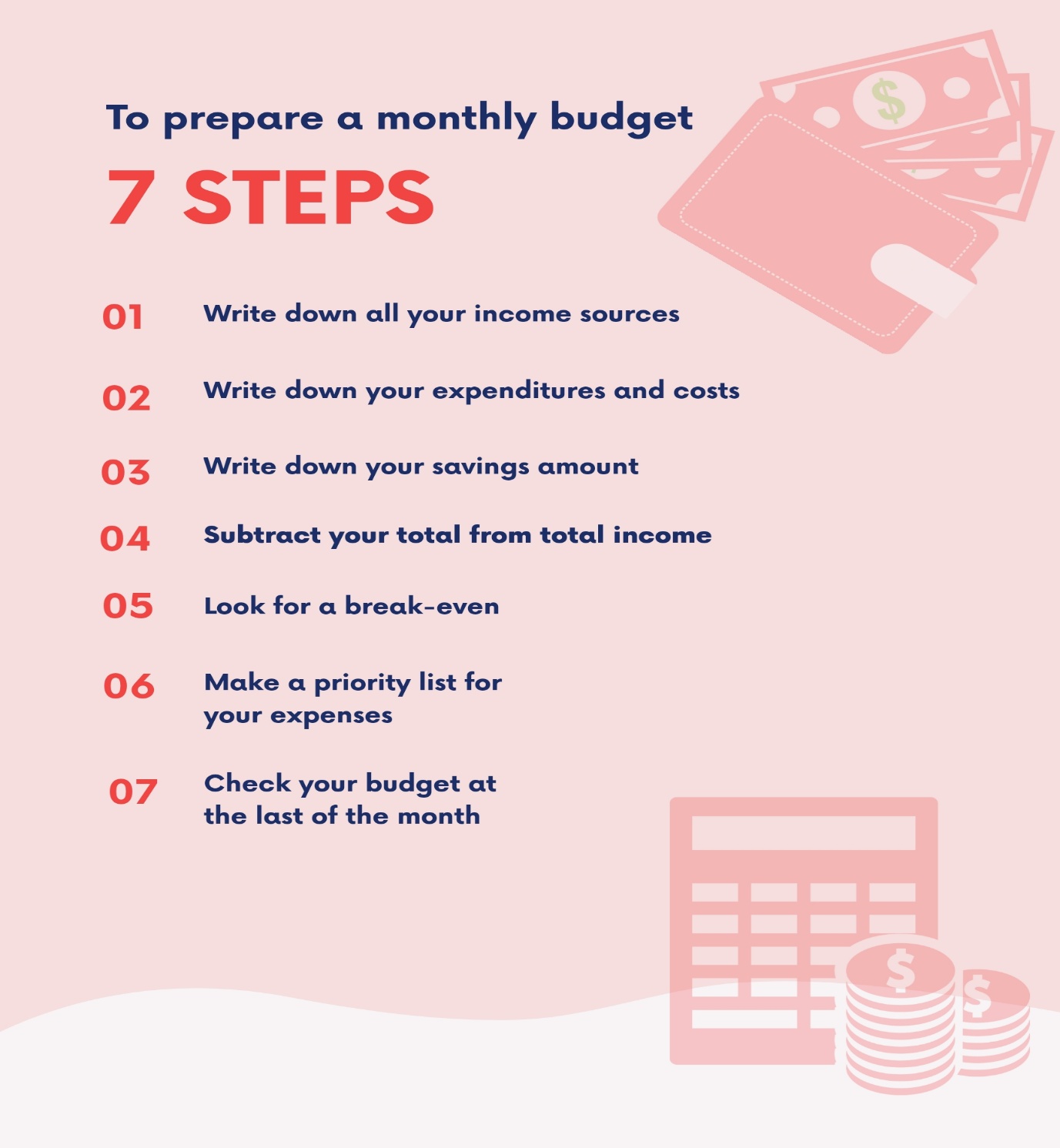

Seven steps for preparing a monthly budgeting

So, as you have read this far, I would assume you want to make a monthly budget for yourself.

To prepare a monthly budget you do need to follow some steps. You will require to take a few steps, calculate some numbers, and then determine your preferences.

Does it sound like a lot of work?

It is not that hard.

Let’s look at the steps more closely and make it easier for you to understand. Here are the steps for budgeting—

- Write down all your income sources

First, you need to be aware of all income sources and then list them down. All the sources that make cash inflow will be included here.

It could be your salary, house rents, interest from the bank, the revenue from your business, the money you collected after selling old stuffs. You can consider every earning sources, no matter how small they are.

Next, make a summation of all the income. That’s your monthly income.

Now, comes the fun part. This will make your budget work.

Just assume that the total income is 5% less than the actual one.

This 5% of your income will prepare you for some uncertain incidents.

- Write down your expenditures and costs

After determining the total income of the month, now what you need to do is make a list for your expenses and costs.

Think of every possible cost that you might incur in the whole month.

The expenses could be your monthly rent, groceries and any household item, the principal and interest expense on your loan.

Now, make a list of all the expenses and total them as you did for the income sources. Write them down and make a total of all the expenditures.

After that, you are ready to move towards the third stage that also includes expenses but in another thread.

- Write down your savings amount

In this step, you need to write down the savings and retirement plan for yourself.

You’ll need to write down how much you need to save in terms of emergency fund, medical fund, insurance, housing, retirement planning, investment.

All these costs must be included here.

All these savings for different categories will be used in your retirement. You must include this section in your budget.

Otherwise, you will not be able to get financial freedom and become financially independent.

These can be considered as expenses for a monthly budget but you need to categorise them as savings and retirement plan because these are mainly for your financial freedom and may remain the same for every month.

That’s why keeping them as a different sector will safe your time for rest the rest of the months ahead.

- Subtract your total expenditures from your estimated income

After determining and estimating all your income, expense and saving, you need to do a calculation here.

The calculations are not hard at all, just some summation and subtraction work need to be done here.

You need the basic math to make a budget. None need specialised accounting or finance to do such calculations.

You need to add Expenditures and savings amount.

After that, you will need to subtract the summation of expenditures and savings from your total estimated income. To illustrate the equation, it is written below —

Estimated Income – (Expenditures + Savings Amount)

After the completion of your equation, you’ll get either a plus amount or a minus amount.

The plus result of your equation means that you have money left even after expending in your expenses.

And the minus figure of your result represents that your expenses have exceeded the income line and this will lead you towards taking loan from people.

- Look for a break-even

After checking the calculations, you have got a positive or a negative number and you already know what they indicate.

To remind you, the positive one presents excess amount of money and negative amount represents that you have exceeded the cost according to your income.

So, in step 5 you need to look for a break-even. But what is a break-even? Break-even means a condition where you make no revenue or have no losses in account.

In easier words break-even means your income and cost is the same amount.

Estimated income = Determined cost

So, after forth step you now need to determine your break-even and cut off some of your expenses. But which expenses are you going to cut off? Surely, you can’t just make a choice like picking up anything. So for that we have our step 6. Let’s move on to step 6 then.

- Make a priority list for your expenses

You know what is a break-even and you need to make a break-even for your budget. For that you are required to cut down some costs. But which one are you going to cut and how are you going to determine that?

By making a priority list. Now your job is to take the list of your expenses and then start prioritising them.

Write down the costs that you will need first. The write down the rest according to their priority.

See if you can postpone them to next month or if you can just eliminate the cost anyhow.

After preparing the priority list, you will know which ones you can cut off to make the break-even for your budget.

This will make you eliminate the unnecessary costs and make a place for the important ones. Now you have a break-even for your budget.

Now you can just prepare a monthly budget for yourself.

- Review your budget last of the month

Following the last 6 steps now you have a monthly budget. But does your work end after making a budget? Or there is some more step to follow?

You need to follow another step, that is to review your monthly budget at the end of the month.

This time you will evaluate the efficiency and effectiveness of the budget and find out the loopholes.

Then note down the loopholes and recommendation which you will follow to make the next budget plan. This will improve your budget making capacity and make your budgets more up to date and efficient.

Also, by doing so, you can identify your mistakes, where you have spent more or which expenses should you give more priority from next time.

This will end up being monitoring and evaluation for your ended budget and a road-map for your upcoming budget plan.

These are the steps you need to maintain to make a good and effective budget. If you can follow these steps, budgeting will become easier for you than before and by every day passing this will become a good habit of yours to use this budget properly.

How monthly budget can save your money

So far you have understood what a budget is, why is it important for you and how to make a budget in seven steps. As mentioned before making a budget will make you save your money and help you become financially independent.

Budgeting will provide you clarity.

So, let’s see how can a monthly budget can save your money and make you feel save in future —

- Your budget will motivate you and manage the fund carefully.

- You will make a plan for your retirement and this will guide you to be financially independent

- Budgeting will help you repay your debts and you won’t need to borrow

- This will help you save up for emergency

- Help you to lead a guilt free life, allowing you to spend money as per your wish.

Types of budgets

There are many tools to use while making a budget. You may select one method that will be easy for you to follow.

The methods used for budgets are —

The No Budget

This one is kind of a trick. If you don’t have a budget, then how can you call it a budget? Believe it or not there are some people out there that just don’t need a budget.

Isn’t that kind of crazy? I know that my family could never do that. I’ve unknowingly tried it before for most of a Christmas shopping season. Without getting into too many embarrassing details, the spending got out of hand quickly that year.

If you are able to not track anything and still spend well below your means, congratulations. For all 99.9% of us, let’s keep looking at this list.

Spending First Budget

While I use a few pieces of some of these I’d say I use this one. This goes contrary to a lot of budgeting advice. The idea here is that you just plan your spending each month and save whatever is left over.

I know it sounds crazy. I think this type of budget is when you know your spending is well below your earning.

I’m fortunate to be in the position, I just try to control my spending each month. I know the rest will work itself out.

Saving First Budget

Here we go. This is the bread and butter. This is the pay yourself first version. You know how everyone says you need to make sure ‘You pay yourself first’.

I’m a big fan, especially when the difference between spending and earning is close.

Saving should be a priority. It should be a priority even if it means sacrificing in other areas.

Getting that savings snowball rolling may be one of the keys to success in personal finance.

There are very few levers one can pull to achieve financial success. Time, savings rate and growth rate.

The only two you have real control over is time and savings rate. Maximizing both of these is vitally important to

The 50/30/20 Budget

I don’t know the details of how my budget would compare to this but do think this is a good way to think about things. The idea is to spend 50% on needs, 30% on wants and save 20%.

If you want some more details on this budget, I’d check this out.

20% is a great savings number to start out with. It’s not amazing but its way above the average. If this is where you find yourself, I’d start with 20% then every few months edge it up by 1%.

Even if you can’t start at 20% shoot for 5% or 10% and work your way up. It’s not about where you start it’s about working towards that vision for yourself.

Have you ever heard how the frog got boiled? It was put in a warm bath then didn’t realize the temperature was gradually being heated up until it was too late.

It sounds like crazy. Start following 50/30/20 rule otherwise, your finance will be out of your hand just like the frog.

The Anti Budget

I truly wish I could operate like this. This budget is amazing because it is so easy and yet still checks all the personal finance check boxes.

Sure, it doesn’t optimize every last detail and collect a lot of data but it more than gets the job done.

The first time I heard about this budget was from Paula Pant. She explained it in a ton of detail.

In reality the concept is super simple. Set aside some set percentage of your income each month (FYI the higher the better) then you can just spend the rest. The best part about this one is you don’t need to track anything.

This budget is best for those that simply aren’t spenders. If you live by yourself and are just inherently frugal, I’d go with this one.

Again, I could never do this. The ideal lifestyle between my household and myself doesn’t 100% align so I fight constantly to avoid lifestyle inflation. It’s a constant battle but one that I proudly fight each day.

The Zero-Based Budget

Zero based budgeting was made famous by the private equity group 3G Capital. It’s something they live by and has worked in most situations (just don’t look up Kraft Heinz).

The best summary specific to personal finance on zero based budgeting comes from Dave Ramsey.

‘You take the amount that you earn each month and then allocate money for different budget categories until there’s nothing left, or you “zero out.”

Sounds pretty simple right? If you use an app like YNAB they follow this same concept with the idea that every dollar has a job.

The Spending Ceiling

The spending ceiling idea is something I came up with myself. No, it’s not some magic budgeting pill you can take. It is similar to a few of the budgets we’ve already discussed.

The idea is that you have a hard cap on your spending. It takes away some of the stress on hitting the exact dollar amount on every single one of your budget categories and just allows you to watch a single number.

If you do take this approach, I’d still highly recommend setting a budget each month. This will ensure that you have some buffer between your expected spending and your spending ceiling.

To me this takes the stress out of accounting for every last detail in our budget while also giving us a little breathing room.

Let’s explain with an example. Let’s say your budget, if you hit it perfectly, is to spend about $4,000 per month. What if you planned on that but set a spending ceiling at $4,400 each month?

This would give you a 10% buffer and you’d know that, once you hit $4,400, you’d have to stop buying things immediately for the rest of the month.

It may not work for some but it sure helps me out

Why following a budget is hard for many of us?

Many people think following a budget is hard and it is true indeed. People can’t do things that they would love to do.

Like, you have made a budget already, now you just can’t add any other expenses to the monthly budget. This will make things harder for you.

It is obvious that you can’t determine all the expenses that are going to occur the whole month. But you still estimate as close as possible.

Sometimes, you get into some unexpected situations where you need to spend money.

For example, you may have a wedding to attend. This will cost you money that you didn’t count or you may have a sudden outing with your friends and ended up spending your money.

These events are not usual, such events will occur eventually. So, people find it hard to keep the budget ongoing with such uncertainties.

But none really cares about looking for a solution rather they just skip the budget. A solution for this problem is just to use the 5% extra income aside you had kept for uncertainties.

In the first step, you kept 5% of your income aside just to make sure that you don’t get into money shortage and face difficulties.

Now as you made few unexpected costs, you may use the 5% money kept aside.

This brings us to a note that, no matter how hard anything ends up being, if you have the will to follow that wholeheartedly then you will surely get a way out.

Everything depends on your mindset.

Budgeting Mindset

So now it’s time to create a budgeting mind-set. Budgeting mind-set means how you think about a budget and money.

How you consider them to be. Even after reading the article this far, I can bet you want to create a budget now and follow it.

But, will you actually do it? Ok let’s assume you will, but can you?

Our psychology is quite weird, but your will and inspiration for making a monthly budget is now high.

After some days, most likely, you will eventually forget about it and lead a messy and not plan your budget again.

So, is there any way out? Yes, there is! You need to make a budging mind-set. You need to determine what you want your money to do for you.

How you are not going to work for money and, instead, make your money work for you.

Think your money as soldiers, they are working hard for your dreams.

This thinking will lead you towards a positive budgeting mind set.

But why is creating a mindset so important? This will make your will for budgeting stronger than before and make you follow the budget.

This will work as a catalyst to you. You are the person behind your budget plan!

Nobody else. If you don’t do it, none will be affected but you. Also creating a positive budgeting mindset, it will make you think about money differently. This will be the turning point of your budgeting plans and financial freedom.

Budgeting Automation Tools you can use while budgeting

You may create the budgets manually and keep tracking as well.

But smart work is better than hard work. You can make the budget using some tools as well. These will save your life hassles and you will save your time as well.

Some of the automation tools will give you some advantages like—

- Time saving

- Same formatting

- Easier calculations

- Easy to use

- Easy to update

There are many applications that you can use to make your monthly budget. Some of the automation tools are mentioned below hereby—

Excel Spreadsheet

An excel spreadsheet is a file that have rows and columns. These rows and columns are used to enter, arrange, calculate, update and sort data. This application understands equations and formulas. By using these anyone can manage to calculate and organize data as per their need.

Any kind of data can be entered into this application. This application is easy to use. This is widely used by every person who needs to do some calculations or keep track of some data. This is a useful and effective tool that can help you while doing the calculations for your monthly budget.

Budget planner or binder

A budget binder is a tool developed to put together budget your money in as reasonable way as possible. It is a digital binder that printable. Also, you can mix and match sheets to create an accurate binder that you need to have.

This tool binder will make you handle the budget easily and it is a great tool to organise your finances and control your money more efficiently. This will give you some advantages like —

- Set goals for your budget

- Keep track of it

- Tract your expenses and income

- Lead you to repay the debts

- Make you take notes

This can be an easy tool that you may use as a beginner to start.

Mint

Mint is a money manager and the financial tracker app. This can bring together all the aspects of your income and expenses. This app is free for 30 days and after the 30-day trial period, you will need to pay $6 per month.

This can be expensive for you to use after 1 month, but this is a great financial app to use. This will work as an assistant for you and lead you towards the bright side of budgeting and money management. This is a highly recommended one for those who can subscribe to the app.

Personal capital

Personal capital is an application that helps you to make personal capital management. This tool can be said as an online financial advisor for beginners and personal wealth management can be done by using this tool. This will ensure the safety of your data and information provided in the app

You may use this application if you want privacy and security of your data. Also, this works as an advisor So, this can be a good choice to make.

EveryDollar

Now comes every dollar app. The other apps were manager, but this one is mainly used to make budgets only. This shows you how to spend the money, save it, and keep the money rolling. This does count every single dollar to make it worth spending. This guides you to the light.

If you want to get the guidance of the full budget and maintain it accordingly. You will need this application. This app will make you know where your every dollar is going and how to use the money wisely.

Conclusion

So, don’t you think that preparing a budget and then maintaining it on a continuous note is profitable? I bet you do. After knowing all the outcomes and benefits of monthly budgeting, you should start to put together your entities and prepare a monthly budget.

It won’t be easy at first, but you should not escape the first step. The first step of any work is the hardest part to complete. When you take the hardest part and then the tool will ultimately become easier for you. What you must do now is take any Budgeting Automation Tool or just take a pen and paper to make the budget manually.

Summarizing the whole article, the things you’ll need to make a budget are mentioned below—

- A Budgeting Automation tool to organize the whole budget electronically

- Pen and paper to note down things you need to include in the budget

- List of your expenditure and costs, basically all your cash outflows

- List of your income sources to identify all your income sources

- Wholistic idea about your debts- repay them as soon as possible

- Determining savings plan, financial goals and retirement plans

- List or your desires and dreams to adjust them in the budget

By following these steps, you will be able to make your monthly budget most easily and efficiently possible. It will lead you towards a secure life to live and help you to become financially free by achieving your financial goal.